Fill Tax Information in Google AdSense: If you are a creator on YouTube, then there’s some bad news for you! From June 2021, the YouTube or AdSense platform will start deducting taxes from creators outside of the United States, on the earnings they make from viewers in the US. March 10 proved to be a dark day for YouTubers because on this day Google told YouTubers bad news. From now on, every Indian YouTuber will have to pay tax for the earnings made on AdSense in the US, that is, if any channel has views from the US, then they get 15% to 24% of the revenue on those views in the form of tax. have to give.

Youtube informs the creators through an email, and the Google-owned company has asked them to submit their tax information in Google AdSense, “to determine the correct amount of taxes to deduct”. However, this new policy applies to all creators outside the US only. No such deductions will happen for those residing in the US.

“Over the next few weeks, we’ll be asking you to submit your tax info in AdSense to determine the correct amount of taxes to deduct, if any apply. If your tax info isn’t provided by May 31st, 2021, Google may be required to deduct up to 24% of your total earnings worldwide,” said Google in the email.

How to Submit Tax Information in Google AdSense

If the YouTube creator doesn’t submit tax info, then the final tax deduction is up to 24 percent of total earnings worldwide if they didn’t submit tax info.

“This means that until the creator submits complete tax info, YouTube needs to deduct up to 24 percent of their total earnings worldwide, not just their U.S. earnings,” YouTube said on its support page. If the creator submits tax info and claims a treaty benefit, then the final tax deduction is $15.

“This is because India and the US have a tax treaty relationship that reduces the tax rate to 15 percent of earnings from viewers in the US,”. If a creator submits tax info but is not eligible for a tax treaty benefit, then the final tax deduction will be $30.

This is because the tax rate without a tax treaty is 30 percent of earnings from viewers in the US. Once Google begins withholding taxes, the creators will see the finalized amount withheld in their regular AdSense Payments Transactions Report.

YouTube Tax Information for Google Adsense

If you are a YouTuber and have monetization enabled on your channel, then you have received a notification about it on the channel, and along with you have got information about YouTube’s new tax on mail and Adsense, if you want to fill your tax information so that you have 24 In place of%, you have to pay 15% tax.

That is, understand that if you earn $ 100 from the US on your channel and you do not provide tax information, then you have to pay $ 24 as tax and if you give information, then you will have to pay $ 15 in tax and the remaining $ 85 will be received in your account. By giving information about tax, you can save 9% tax.

YouTube also created a video to explain these new tax deductions and help creators provide their tax information. The company has also tweeted the new rules through its social media channels.

Many creators have criticized YouTube for this move, considering it already takes a cut of revenue from the ads it serves on the platform. The change is also believed to largely affect small creators who don’t have millions of subscribers to attract sponsors for native advertisements.

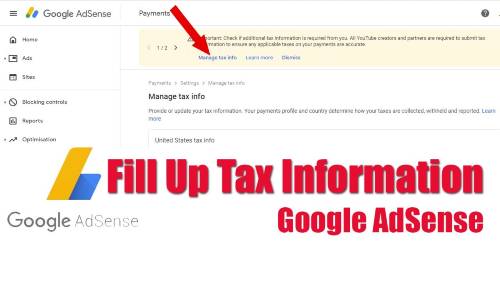

Step by Step Guide How to Fill Tax Info in Google AdSense?

- First, log in to the Google AdSense account linked to your YouTube Channel.

- Then, click on Payments.

- Scroll down to find the Manage Settings option.

- Under the Payments section, click on the United States tax info option.

- Click on Add Tax info and confirm your Gmail account password to move forward.

- Now, select ‘Individual’ if you’re an independent creator and ‘Non-Individual/Entity’ if you’re a company.

- Click on ‘No’ if you’re not a U.S. citizen or resident.

- Select between W-8BEN and W-8ECI forms. (Select W-8BEN if you’re an individual creator simply earning through Google Ad revenue)

Note: W-8BEN is for non-US individuals that would be used to claim tax treaty benefits. Whereas the W-8ECI form is for non-US business entities or individuals who file US income tax returns and earns from US trade or business. - Now, fill up the details like country of origin, Tax Identification Number, address, etc.

Note: You must give the Foreign Tax Identification Number (PAN Card number in case of Indian creators) to claim the tax treaty. If you’re eligible for the tax treaty, you’ll have to pay a 15%(In the case of Indian creators) tax from the money you make from U.S. viewers. However, if you’re not eligible, you’ll be charged 30% tax. - If you claim tax treaty, checklist income types that apply to you, i.e., Services (AdSense), Motion Picture and TV (YouTube, Google Play), Other copyright (YouTube, Google Play).

- Finally, preview your document and move ahead to the certification section.

Note: Before submitting the form, you must preview it to ensure all the information is correct.

Important Links for AdSense Tax Filling Form

You can go through the below links before filling out the U.S. tax form:

How to update your US tax information

YouTube creators need to submit their US tax information on the Google AdSense page. Here’s a step-by-step method that creators need to follow:

- Sign in to the Google AdSense account.

- Click on payments.

- Click on manage settings.

- Scroll to the payments profile, and click edit next to the United States tax info.

- Click manage tax information. Fill in the required details.

Creators may need to re-submit taxation information every three years. Moreover, only Latin characters can be used when submitting tax forms. Creators can see the finalized amount withheld in their regular AdSense payments transactions report.

YouTube AdSense Tax FAQs

How to fill in Tax Information in Google AdSense?

We clearly tell you about How to fill in Tax Information in Google AdSense, You can read this article to learn about the Google AdSense Tax Fill Process.

What happen if I didn’t Fill Tax Information in AdSense?

If you or any creator does not Fill in Tax Information in AdSense then YouTube or Google deduct 24% tax from their earning.

Is It Necessary to Fill Tax Information in AdSense?

If you want to pay less tax then you need to Fill Tax Information in Google AdSense.